To improve the literacy rate in the country, the government of India has launched number of tax exemptions that allows citizens of the country to reduce taxes on their incomes. Trutax will help you to know the regime in better way & how to claim the benefits of it.

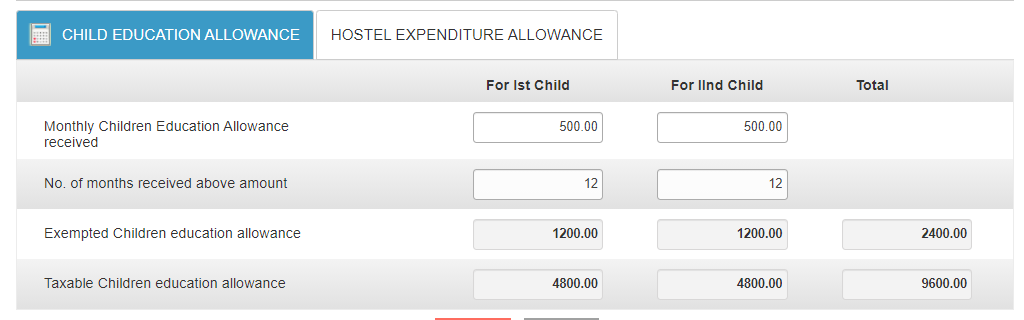

The government of India has been offering exemption of Rs. 100 per child limited at 2 children’ per family for education purposes known as children education allowance. The maximum age limit to redeem the exemption is 20 years under the regime.

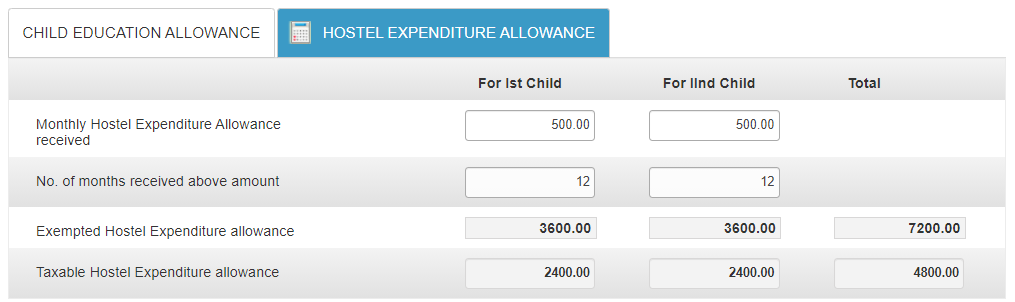

Trutax explains that a minimal amount of your income is tax exmempted for the purpose of your children’s education under Under Section 10(14), of the Indian Income Tax Act, 1961. This allows you to redeem Rs. 100 per child for a maximum of two children’s if you are living as a nuclear family. You can also claim upto Rs. 300 per child maximum 2 children’s if your kids go to boarding schools, where they study & also live.

The sub-section of this income tax act is known as the Hostel Expenditure Allowance, which is the successor of previously known as the Children Education Allowance (CEA). Just not that, in 2008 with many new policies more allowances were added for the people working in public sector. Depending on their different eligibilities they were able to redeem many different types of reimbursements & tax exemptions for their child’s educations fees.

Trutax would also like to list down the types of reimbursements you could rope in for your child’s education funds.

The clause No. 12011/03/2008-Estt (AL) dated 2.9.2008, has explained that areas like tuition fee, admission fee, laboratory fee, special fee charged for electronics, music, agriculture, or any other subject, practical work, fee paid for the use of any aid or appliances by the child, library fee, games/sports fee and fee for extra-curricular activities can be reimbursed under the act, but school can charge the amounts directly from the parents. Moreover that exemptions for purchase of stationaries like textbooks & notebooks, uniforms, pair of shoes are roped in for reimbursements during the academic year.

Trutax promises to help you in every step of claiming diversified tax regimes by Government in an easy way, here is how you can be eligible for your child’s education.

Under the CEA regime no minimum age is listed however there are certain criteria’s that are considered for your child’s admission in nursery classes. At first, for children who are challenged or specially abled the minimum age falls minimum of 5 years. Also, the prescribed policy limits disabled children reimbursements if he/she is admitted to non-formal or vocational education.

But a recent amendment on 21st February, 2012 the scripted minimum age for special abled children was removed to no minimum age, to which you can claim reimbursements.

However, there’s a maximum age of 20 years for normal child & 22 for challenged or specially abled children for CEA compensations. This clause is based on O.M. No.12011/07(ii)/2011-Estt.(AL) dated 21.02.2012 refers.

Not just your child eligibility is important, But Trutax will also let you know that schools eligibility is also important for reimbursements claims.

Your child’s education school or institution needs to be recognized by the central or state government or UT administration or by university or a recognized educational authority having legal jurisdiction over the region where it is operating. Authorities have also mentioned that the eligibility also applies to the children’s prior classes. The clause is under OM No.12011/03/2008-Estt.(AL) dated 23.11.2009”.

Government of India has also benefited the central government employees with extra benefits under CEA. Trutax would like to mention what extra perks officials of governments have.

CEA has benifited Central Government employees including citizens of Nepal and Bhutan to pay all the education expenses of their children, whether it is abroad or in-region studies. The only eligibility that stands for them is requirement of a certificate from the Indian mission abroad explaining that the education institution is recognized by the authorities having jurisdiction over the operating region.