House Rent Allowance, is a part of the service sector for people who are living in rented space. Being part of a salary, HRA is an exception as it is not fully taxable. Subject to specific conditions, a piece of HRA is excluded under Section 10 (13A) of the Income-charge Act, 1961. At Trutax, we measure if the HRA exclusion is deductible or not from the complete payment before showing up at an available pay.

This causes a representative to spare expense. Yet, do remember that the HRA got from your manager, is completely available if a representative is living in his own home or on the off chance that he doesn’t pay any lease.

This deduction is allowed under Section 10(13A) of the Income-tax Act, in obedience to Rule 2A of the Income Tax Rules. You fall under the exemption scheme if you stay in a rented house & get an HRA from your employer.

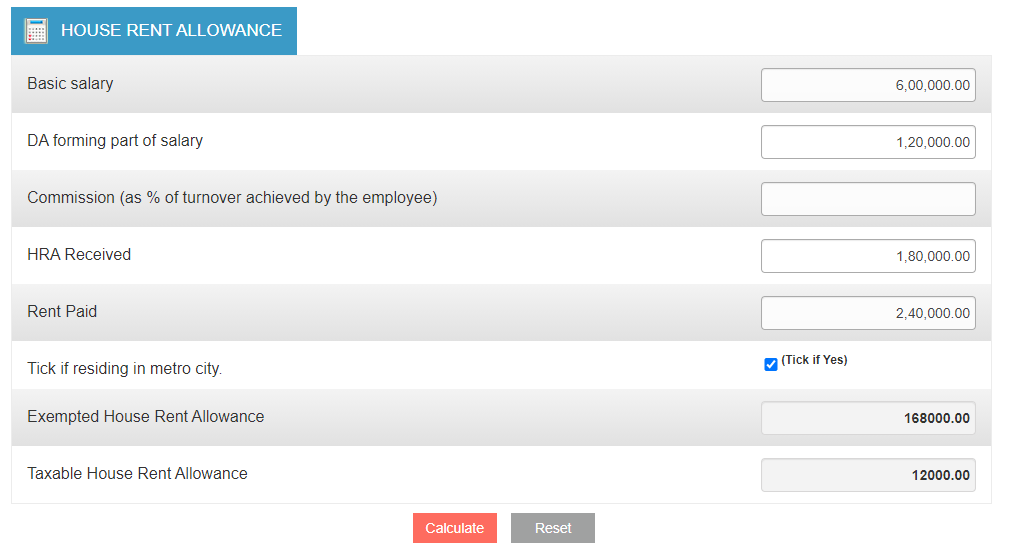

Trutax helps you with the factors like HRA derivation depends on compensation, HRA paid a genuine lease paid and a spot of living space. The slots for deductions percentages are also divided. For metro cities, the expense exception on HRA is 50% of the essential compensation, while for non-metro cities it is 40% of the fundamental compensation. At Trutax, you can easily check the percentages of your HRA exemptions.

Here are the other factors from trutax that helps you in exempting yourself from HRA.

To collect the exemption, the mentioned address should be leased in the right way & should be paid off on papers. The rent allowance provided by the employer within your salary is the calculated time during which you can claim the actual accommodation paid rent for your living space. Accounting less 10 percent of basic pay 50 percent of basic salary if you reside in Mumbai, Calcutta, Delhi, or Chennai, or 40 percent if you reside in other cities.

To guarantee the exemption, the lease for the house should be paid for the same premises mentioned in the documents & is involved.

HRA exceptions can be benefited just on accommodation of lease receipts or the lease concurrence with the house proprietor. The representative must report the PAN of the ‘landowner’ to the employer if the lease paid is more than Rs 1,00,000 every year to profit the advantage.

Trutax wants to specify that, the rented premises must not be owned by you. Anyway long the rented house isn’t controlled by you, the special case of HRA will be available up quite far decided.

With the ultimate objective of this determination, pay suggests key pay and fuses dearness reward, if the terms of employer give it, and commission subject to a fixed degree of turnover achieved by the laborer.

The determination is available only for the period during which the rented house is included by the agent and not for any period after that. It is to be seen that the tax cuts for home advances and HRA are two separate viewpoints.

If you are paying rent for convenience, you can guarantee tax breaks on the HRA part of your compensation, while likewise profiting tax reductions on a home credit.

You have to submit confirmation of lease paid through lease receipts, properly marked and stepped, alongside different subtleties, for example, the leased home location, name of the proprietor, time of the lease, and so on

How it applies:- For instance, accept one procures a fundamental compensation of Rs 30,000 every month and rents a level in Mumbai for Rs 7,500 every month. His genuine HRA is Rs 12,000. He is qualified for 50% of the fundamental compensation for the HRA exception.