The due date for e-filing income tax returns for salary individuals is 31st July, 2017.

The due date of filing income tax returns for business is 30th Sept,2017.

The government has made various changes in income tax return forms this year which every individual should know while filing income tax returns.

Details and changes in income tax returns forms: https://www.trutax.in/charts/which-itr-to-file

You can use TruTax for e-filing your income tax returns and complete the process in 5 minutes.

If you are getting the salary then upload your form-16 on TruTax.TruTax will help you to prepare your e-file quickly.

Upload your form 16: https://www.trutax.in/sign-in

Rules to follow while e-filing income tax returns by salary individuals:

- Verify TDS details in Form 26AS.

- Choose the right form while e-filing taxes: TruTax automatically selects the right form for you and it support all the ITR forms (ITR1, ITR2A, ITR 2, ITR 3, ITR 4, ITR 4S, ITR 5, ITR 5, ITR-6 and ITR 7.

- Mention cash deposits after demonetisation.

- Include interest and other income while e-filing tax returns.

- Mention your Aadhaar while filing ITR.

- Mention income from previous employer.

- File your taxes before deadline to avoid any penalty.

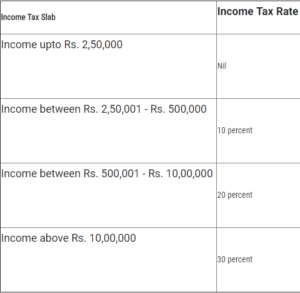

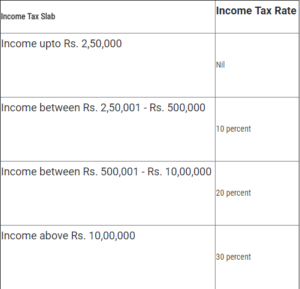

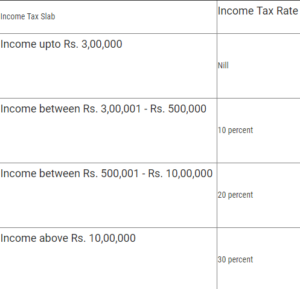

Tax slab for individual taxpayers help you understand your existing tax liability.

If you are self-employed then there are some ways through which you can e-file for returns and deductions and save on taxes.

- E-filing for deductions under Section 80 which can be claimed even by self-employed individuals.

- E-filing for claim deductions under Section 80C.

- E-filing for deduction under section 80G.