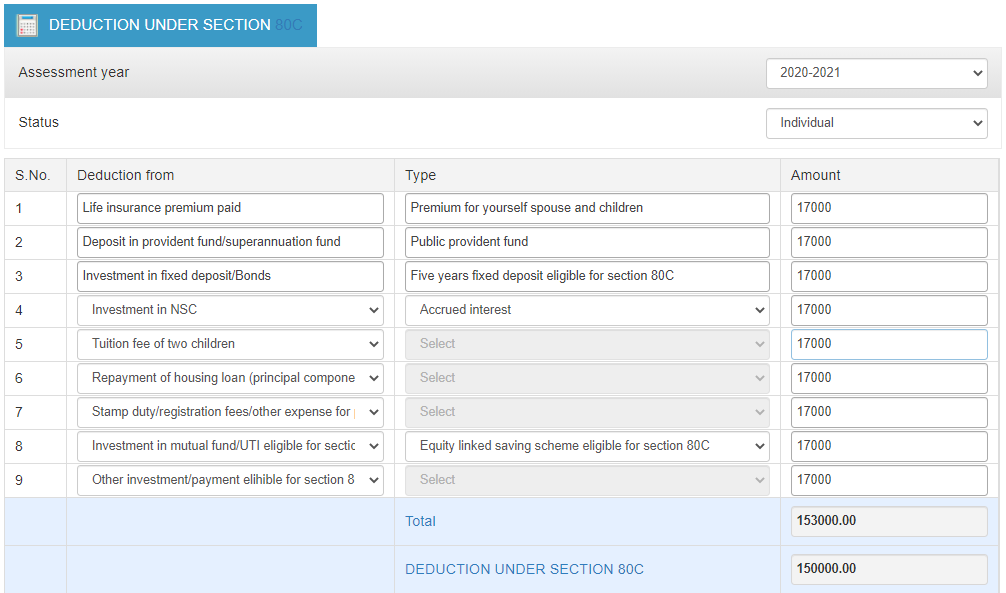

Clause 80C of the Income Tax Act of India is a provison that focuses to different consumptions and investments that are excluded from Income Tax. It takes into account a most extreme derivation of up to Rs.1.5 lakh consistently from a speculator’s all out available pay. Area 80C is material just for singular citizens and Hindu Undivided Families. Corporate bodies, large firms, and different organizations are not qualified to benefit charge exceptions under Section 80C.

The clause 80C is also divided further into the sub-sections that explains different eligible investments to claim 80C benefits. Trutax helps you to go through them & plan your money in a smart way.

Section 80C – Interests in Provident Funds, for example, EPF, PPF, and so forth, installment made towards life coverage expenses, Equity Linked Saving Schemes, installment made towards the chief amount of a home credit, SSY, NSC, SCSS, and so on

Section 80CCC – Installment made towards benefits arrangements, just as shared assets.

Section 80CCD(1) – Installment made towards certain Government-sponsored plans, for example, National Pension System, Atal Pension Yojana, and so forth.

Section 80CCD(1B) – Ventures of up to Rs.50,000 in NPS is considered for exception under this part.

Section 80CCD(2) – Organisations commitment towards NPS (up to 10%, containing essential compensation and dearness recompense, assuming any) is absolved under this classification.

Trutax would also like to mention the government approved investments that are eligible for deductions.

Sukanya Samriddhi Yojana – Sukanya Samriddhi Yojana is a plan uniquely intended to meet the monetary necessities for daughters schooling and marriage. Guardians or lawful watchmen of a young lady youngster (not more seasoned than 10 years old) can open this record and guardians of at least 2 (just in the event of twins) young ladies can likewise put resources into this arrangement. The premium procured from this speculation plot is qualified for charge exception under Section 80C.

Segment 80C highlights various instruments, an exhaustive thought of which should be available with each speculator. The advantages offered by this demonstration can help spare a considerable sum from one’s duty obligation.

Stamp duty and registration charges – Stamp obligation and enrollment charges can be considered as the two biggest costs made towards taking responsibility for property. The Government of India permits an allowance of expense risk till as far as possible on the stamp obligation and enlistment charges paid towards house acquirement. Nonetheless, exclusions must be asserted in the year that these obligations are paid; else it won’t be qualified for thought under Section 80C derivation.

Principal repayment made towards home loan – Just the reimbursements made towards the essential part of home credit EMIs are qualified for derivation under Section 80C.

Senior Citizens Savings Scheme – Any ventures made towards Senior Citizens Saving Scheme, (or SCSS) is qualified for charge exclusion up to the most extreme assigned 80C cutoff, for example Rs. 1.5 lakh. People over the age of 60 (individuals settling on deliberate retirement conspire is qualified to partake in SCSS after the age of 55 years) a long time are qualified to get advantage from SCSS, which has a base lock-in residency of 5 years.

Equity-Linked Saving Scheme – Equity Linked Saving Schemes, or ELSS, falls under Section 80C’s exclusion classification for up to its greatest cutoff (Rs.1.5 lakh). These venture plans accompany a compulsory long term lock-in period.

Infrastructure Bonds – Area 80C of the Income Tax Act permits charge exclusions on framework bonds, given the venture is equivalent to or higher than Rs.20,000. The constraint of Rs.1.5 lakh remains relevant for these drawn out made sure about bonds also.

EPF – The return procured from Employee Provident Fund (EPF), including the interest, is qualified for charge exception under Section 80C of the Income Tax Act, 1961. It is just qualified for workers who have proceeded with their administration for in any event 5 years. In the event that people make intentional commitments to their EPF accounts, such sum is qualified for charge exclusions under Section 80C.

Tax Saving FD – Tax Saving FDs are fixed store plans offered by the two banks and mail centers that permit charge allowance under Section 80C. These FDs have a lock-in time of 5 years and offer a limit of Rs.1.5 lakh charge exception (on the chief sum). Nonetheless, the profits of such instruments are obligated for tax collection.

National Savings Certificate – NSC or National Savings Certificate is one of the most well known expense sparing instruments for hazard deflect people. Premium procured on NSC is accumulated semi-yearly, and the greatest development time frame goes from 5 to 10 years.

Speculators don’t need to follow any impediment on the complete aggregate put towards NSC in a monetary year; notwithstanding, just a limit of Rs.1.5 lakh will be dependent upon exclusion each monetary year under Section 80C.

Unit Linked Insurance Plans (ULIPs) – Unit Linked Insurance Plans offer more returns in the drawn out when contrasted with customary protection approaches. They have gotten particularly famous lately on account of the tax reductions offered under Section 80C of the Income Tax Act, 1961. Speculators can profit charge exceptions up to Rs. 1.5 lakh on the contributed sum u/s 80C annual expense arrangements.

NABARD Rural Bonds – NABARD represents National Bank for Agriculture and Rural Development. Country Bonds offered by NABARD are qualified for charge exclusion under the Income Tax Act of India. The greatest deductible sum is covered at Rs.1.5 lakh under Section 80C.

Public Provident Fund – Any commitment towards Public Provident Fund (PPF) can be petitioned for charge allowance under Section 80C. Public Provident Funds accompany a most extreme store cutoff of Rs.1,50,000, permitting a speculator to guarantee the whole kept sum as an exception under this Income Tax act.

Any deliberate commitment made by the worker towards the gave reserve is likewise qualified to burden allowance under Section 80C of the Income Tax Act.

Life insurance premiums – Charges paid towards extra security strategies are qualified to get tax cuts according as far as possible. These exceptions are accessible against strategies held without help from anyone else, companion, subordinate youngsters, and so on Hindu Undivided Family individuals can likewise profit by similar exceptions.

As of now, a yearly expense of up to 10% (of the protection strategy’s complete aggregate guaranteed) is charge absolved under this plan. This statement has been modified on first April 2012, before which charges of up to 20% (of the total guaranteed) was subject for charge exception under Section 80C derivation.