The price of a product increase overtime, and this brings down the purchasing power of money. Say, if 5 items can be bought for Rs. 500 today, tomorrow you may only be able to buy 4 items at the same rate on account of inflation. Cost inflation index calculates the estimated rise in the cost of goods and assets year-by-year as a result of inflation. It is fixed by the central government in its official gazette to measure inflation. Section 48 of the Indian Income Tax Act, 1961, defines the index as notified by the government every year.

Cost Inflation Index is a measure of inflation, used to calculate long-term capital gains from sale of capital assets. Capital gains is the profit that you make from selling an asset, which can be real estate, jewelry, stock, etc. The entire process – where the capital asset’s cost price is adjusted with the effect of inflation using the cost inflation index number – is referred to as indexation.

Calculate Cost Inflation Index

To know how you can calculate cost inflation index, consider the following example:

Example

Purchased property on August 1, 2004 = Rs. 30 lakhs Sold property on April 1, 2018 = Rs. 85 lakhs

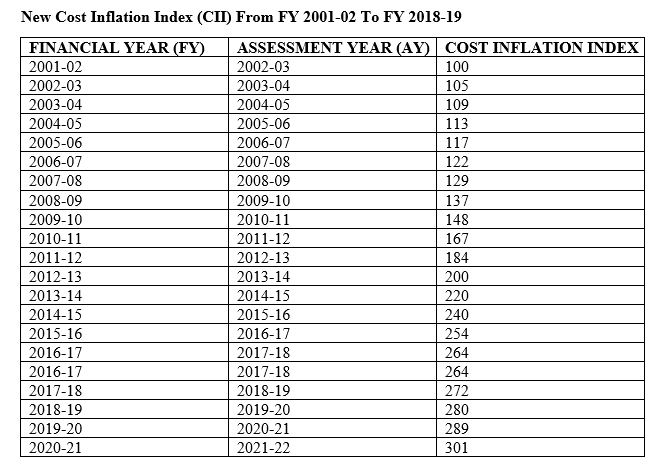

Indexed cost of acquisition = Rs. 30 lakhs x 280 / 113 = 74.33 lakh

Capital gain = Rs. 85 lakh – Rs. 74.33 lakh = Rs. 10.67 lakhs

Base Year In Cost Inflation Index

The government has set a specific calendar year as the base year, and accordingly calculates the CII beginning from base year. To ascertain the rise in inflation percentage, index of the other years is compared to the base year. Finance Minister, Arun Jaitley, recently announced the change in base year from 1981 to 2001.

For the purpose of computing long term capital gains, the property seller has to calculate the indexed cost of purchasing the property. To assess the indexed cost, the seller needs to multiply the property’s cost of acquisition with the cost inflation index, as notified by the tax authorities for the year of transfer. This figure then has to be divided by the cost inflation index of the year of purchase. But, should the property be purchased prior to the base year of cost inflation index, one needs to know the property’s fair market value for the base year.

Shift In Cost Inflation Index Base Year From 1981 To 2001

Earlier, 1981-82 was regarded as the base year. However, taxpayers started facing problems in getting their properties valued for purchases prior to April 1, 1981. Tax authorities were also facing difficulties relying on the valuation reports. Thus, the government decided to shift the base year to 2001, so that valuations can be done accurately and faster. In case of capital assets bought before April 1, 2001, taxpayers can take higher of actual cost or fair market value as on April 1, 2001, as the purchase price and enjoy the benefit of indexation.

Changing the base year helps capture the property’s inflated cost in a better manner, bringing down the capital gains and the tax burden.