ITR Form 16 is one of the most common financial documents anyone could come across when filing for Income Tax Return.

This year, the Income Tax department has studied the layout of Form 16 by including various details to make them more elaborated. The variations in ITR Form 16 format have been made to bring them in similarity with the latest variations made in ITR (income tax return) forms.

The revised format for ITR Form 16 has already been notified by the Income Tax department and will come into effect from May 12, 2019. In short, this means that the income tax returns for the financial year of 2018-19 will have to be filed on the basis of studied Form 16.

Understand Form 16

Form 16 is a certificate (issued under section 203 of the Income Tax Deducted at Source (TDS) by the employer and submitted by them to the Income Tax Department (IT Department). It has details of how much tax did the employer subtracted and when was it submitted to the IT department.

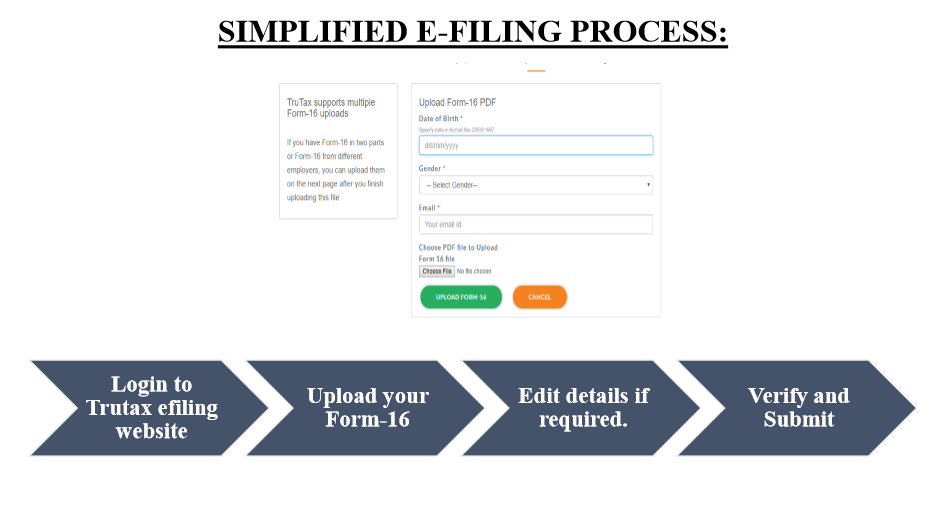

In case you have changed jobs during the year and moved on to another job, or have worked with different employers at the same time, and tax has been subtracted in all places, you will have to get different Form 16 from all of them.

However, if your employer(s) did not subtract any tax from your salary, considering your income for the year is below the tax-exemption limit, they may not issue ITR Form 16.

Following points will help you Understand Form 16

- Form 16 has two different parts which are Part A and Part B, which replicates most of the details divided into parts. These features of Form 16 are very important when filing IT returns.

- Part A of Form 16: This form includes the basic detail of the employee and the employer, it also consists of details of how much tax was deducted and the dates, that when was it deposited.

- Part B of Form 16: This form has the division of how the tax was computed considering declaration which is made at the beginning of the financial year.

- Benefits of Form 16: Form 16 works as a proof for you that your employer has deposited the TDS amount and has not conducted any fraud.

Filing ITR Form 16

Form 16 is one of the most significant official documents you need when filing your IT returns. Whether you’re filing your returns on your own, or pursuing help from your Chartered Accountant, it is important to understand the processes for filing returns with Form 16.