Understand Form 16

- Form 16 is a certificate or a document that is issued to salaried personnel in India by their respective employers about Understand Form 16.

-

The certificate carries necessary details that assist in the process of filing Tax Returns. Form 16 is provided by an Employer to the Employee and is used by the employee as a reference as well as proof while filing Income Tax Returns.

The process of filing income tax returns has been started, amid the process the government making Aadhaar card mandatory to file income tax returns.

PAN number is mandatory to file income tax returns. The government has announced on Sep 21 that it has made the Aadhaar card mandatory to file ITR.

- If you are filing your income tax returns the first time then you must need to know about the very important form: Form 16.

- Most of the time especially salaried employees who are filing their income tax returns the first time don’t know what to do or figure out with the form- 16 when their employer hands over this form to them.

- Form 16 is the salary certificate as it is issued by employers even when there is no TDS on the salary of the employee.

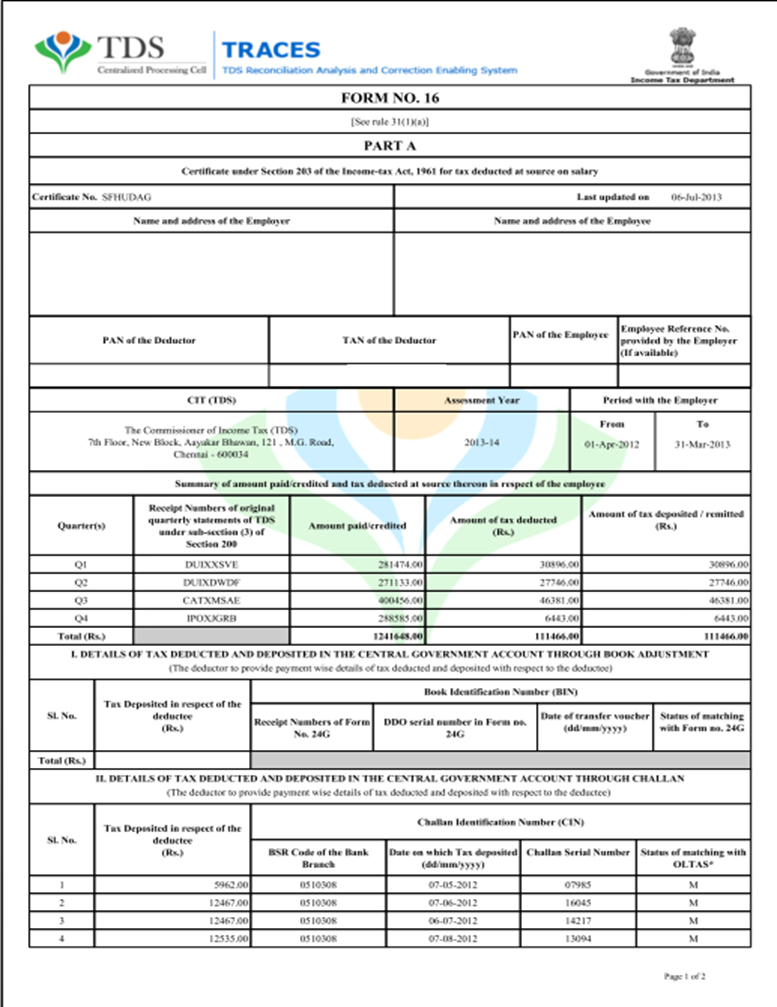

Form 16 is divided into two parts. Part A and Part B.

Part A: -

- Form 16 is the certificate of TDS. Hence Form 16 becomes proof of the TDS deducted by the employer from the salary of the employee and paid into the government account.

- Part A consists of your personal details such as your name and address, your employer’s name and address, PAN of both, employer’s Tax Deduction Account Number (TAN), and others. This detail helps the I-T department track the flow of money from you and your employer’s accounts.

Details Required

- Name and address of the employer.

- PAN of the employee.

- TAN and PAN of the employer.

- Summarily of tax deducted and deposited quarterly, which is certified by the employer.

- Assessment Year.

- Period of employment with the employer.

- Part A of Form 16 has a unique TDS certificate number.

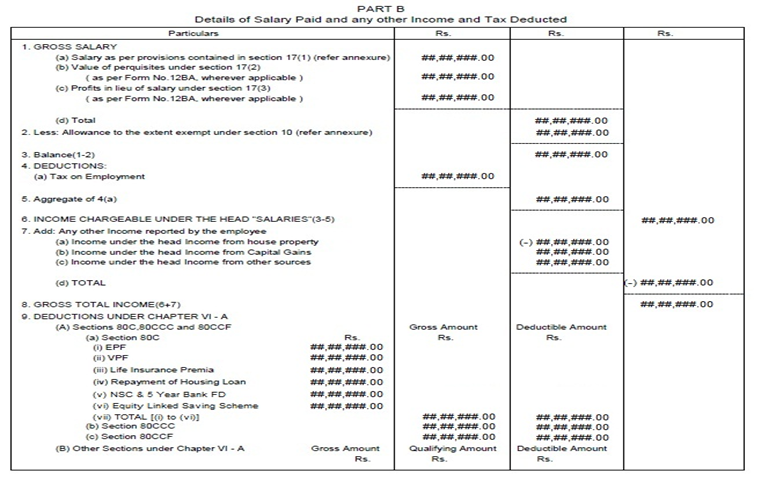

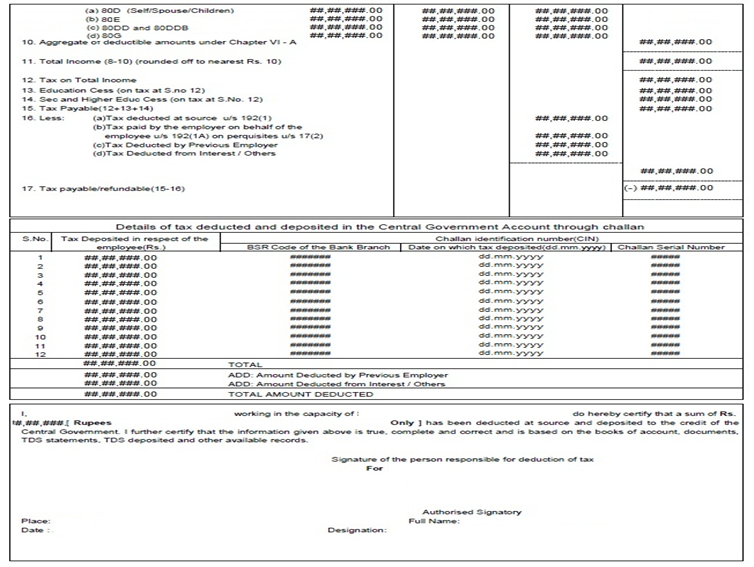

Part B is an annexure containing details of salary paid, other income, tax due, and tax paid. This is a complete detailed record of salary and related deductions and exemptions computed in a step-by-step manner.

Details Required

- Taxable Salary

- Deduction allowed under the income tax act

- The breakup of Section 80C deductions.

- If you held more than one job during the year, you will have more than one Form 16.

- Part B is prepared by the employer manually and issued along with Part A.

Email already exists.