Taxpayers are usually aware of deductions under Section 80C of the Income Tax Act for which they are eligible. However, it is noticed that taxpayers are unaware of taxability of allowances and the exemptions available under different sources of income.

If you think that your entire salary is liable to taxes, then that is not true. Your overall package, often known as CTC, comprises of many allowances. Allowances are the financial benefit given to the employee over and above the monthly salary, and hence these are also known as salary allowances. Allowances are particular in nature and are provided to meet the specific requirements of employees.

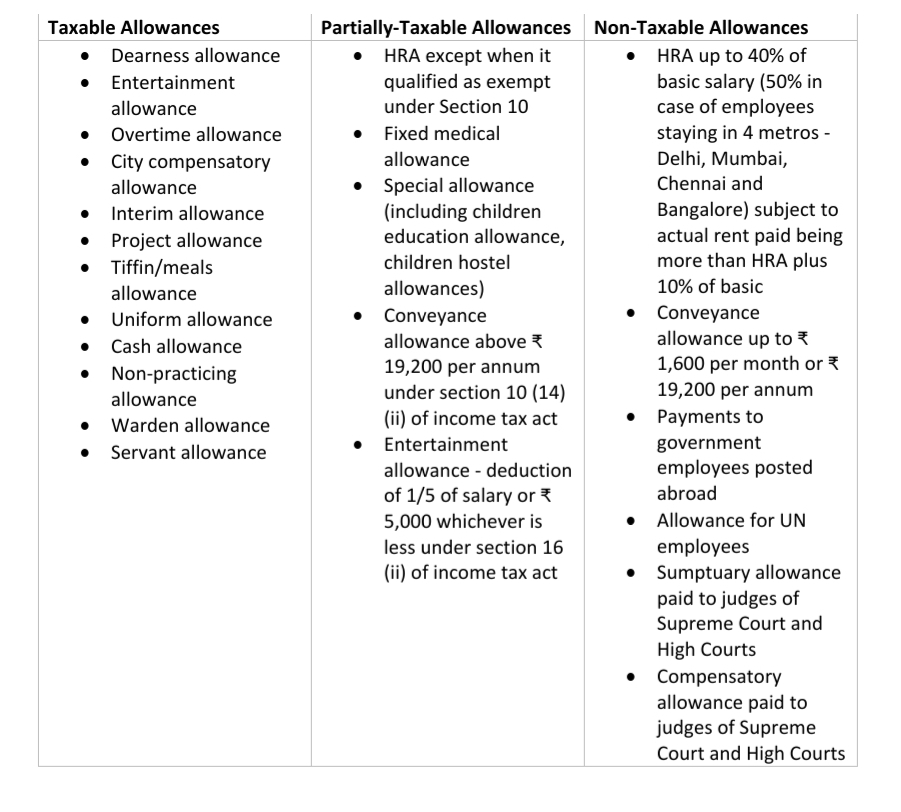

Most of the times, employees often get confused between ‘Allowances’ and ‘Perquisites’, failing to understand the basic difference between the two. However, it’s important to comprehend that all allowances are not taxable. As an employee, you must know which allowances in the salary slip are actually taxable. This would help you save taxes most efficiently.

Types of Allowances