If you get the Notice under Section 139 (9) then it is about Defective Return Notice. You can get this Income Tax Notice under Section 139 (9) due to various reasons and mistakes done while filing your income tax returns. There is no need to panic about this notice as you just need to understand the reason behind it which you will get through the mail by Income Tax Department.

In case if you will get this Defective Return Notice then you just need to correct your mistakes and provide the required information mention on mail while filing your return again within given deadline. You will get 15 days to rectify the errors and file your returns correctly. In case if you ignore this notice and fail to rectify the errors mention by the Income Tax Department then your return will be treated as invalid which can be resulted into serious consequences.

Reasons of Defective Return Notice under Section 139 (9):

– Proof of TDS, Advance Tax and Self Assessment Tax.

– Incorrect Income Details Information.

– Claiming Income Tax Refund without paying full taxes.

– Mismatch name on Income Tax Return and PAN Card.

– Fail to provide copy as proof in case of audit under Section 44AB.

– Incorrect income information under the head “profits and gains”.

– Failure to provide mandatory information in ITR form.

It is very important to rectify these errors and file your income tax return within given deadline.

How to rectify the errors in Defective Return Notice u/s 139 (9)??

The process to submit the response to Defective Return Notice under Section 139 (9) as follows:

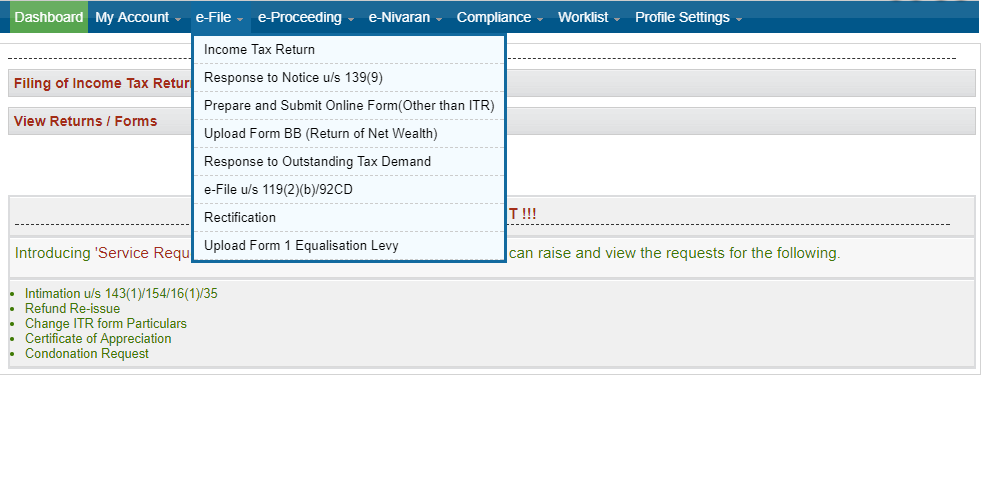

-Login to Income Tax e-filing Website: http://www.incometaxindiaefiling.gov.in/.

-Click on “e-file in response to Notice u/s 139 (9).

-You will be redirected to the page where you can check the Defective Return Notice Information.

-If the assesse agree with the specified defective return info then you need to select “Yes” under the column name “Do you agree with defect”. In other case Assess can also select “No” if assesse does not agree with the defective return and mention remarks also to provide information.

-If Assesse is agree with defective return and selected “Yes” then Assesse need to upload the relevant XML Return.

-On successful completion of the response to the defective return assesse can view the success screen and click on “View” link under response column. Assesse can also note down the acknowledge number and date while filing the Return.