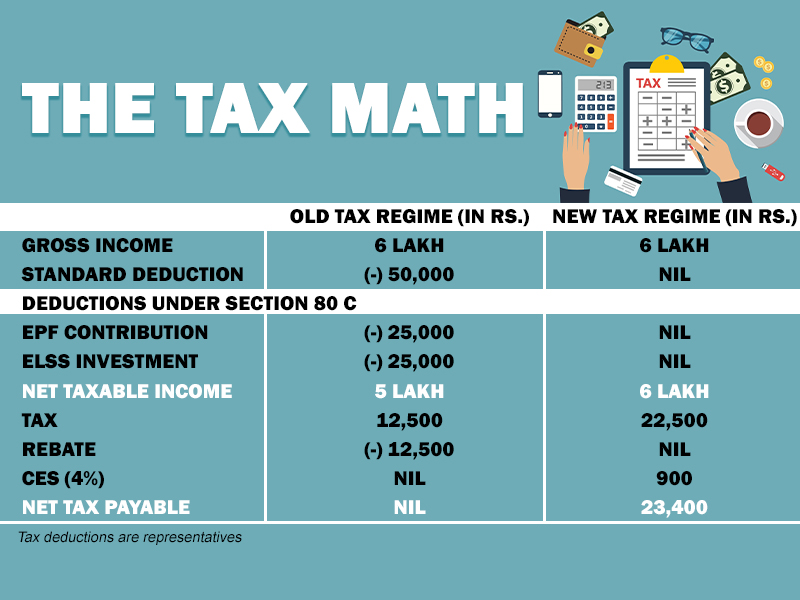

Finance Minister Nirmala Sitharaman, in her Budget speech, announced a new, simplified income tax regime for taxpayers with revised income tax slabs and tax rates. While the government has introduced a new tax regime with revised slabs and rates, those availing these new slabs will not be eligible for rebates and exemptions.

“The new tax regime shall be optional for the taxpayers. An individual, who is currently availing more deductions and the exemption under the Income Tax Act may choose to avail them and continue to pay tax in the old regime,” she said in her speech.

The Budget offered taxpayers the option to pay tax as per the new regime under reduced rates with no exemptions. Under the new tax regime, taxpayers will not be eligible for rebates and exemptions. They can avail rebates and exemptions by staying in the old regime and paying tax at the existing higher rate.

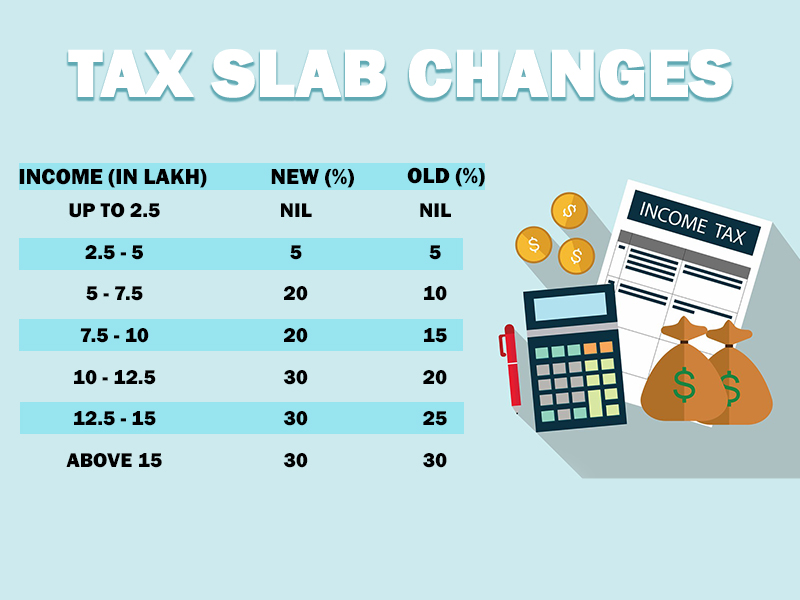

Under the new tax regime, taxpayers will have to pay no tax for annual income up to Rs 2.5 lakh. Individuals earning a salary between Rs 2.5 lakh and Rs 5 lakh will pay 5 per cent tax. While income between Rs 5 and 7.5 lakh will be taxed at 10 per cent, earning of Rs 7.5 and 10 lakhs to levy 15 per cent tax. Taxpayers will have to pay 20 per cent and 25 per cent tax for incomes between Rs 10-12.5 lakh and Rs 12.5-15 lakh, respectively. Income above Rs 15 lakh will be taxed at 30 per cent.

The new tax regime, though optional, will need taxpayers to forego various tax exemptions available in the old regime. So, the net benefit under new tax structure may not be positive for all taxpayers. One needs to do a proper planning of the actual tax savings before switching to the new regime if you are already claiming deductions under 80C or 80D under old tax regime.

Krishna Kumar Karwa, Managing Director – Emkay Global Financial Services, said, “The option to individuals to opt for a lower tax slab structure with no deductions or to continue with the earlier higher slabs with deductions for home loan EMIs, investments in insurance etc seems slightly confusing. In a country like India with a young population with poor social security it is imperative to incentivize young India to save for the future and own a house as well,” says Krishna Kumar Karwa, Managing Director – Emkay Global Financial Services.

On top of it, the option to choose the old or the new income tax regime will just complicate filing income tax returns which was already a complicated process for individual tax payers, says Ankur Choudhary, Co-Founder & CIO, Goalwise.com.

However, if you are an NPS subscriber, you can continue to avail deduction under Section 80CCD (2) if your employer contributes towards your NPS account. “NPS deduction of 10 per cent from employer is the only tax benefit in the new tax regime because section 80CCD (2) has been kept independent. Employees with Rs 15 lakh salary may prefer opting for NPS more,” he says.

Comparing both

Below is

shown the amount of tax saved or extra tax payable for a salaried individual at

different salary levels under the existing tax regime and the new proposed tax

regime.

Case I—Salaried individual not claiming any

exemptions or deductions

Assuming no tax deductions or

exemption are claimed in the existing personal tax regime, the individual with

gross salary of Rs 7.5 lakh would save tax of Rs 15,600 if he/she opts for the

new personal tax regime. At Rs 10 lakh, the individual would save Rs 28,600 in

tax and at Rs 12.5 lakh he/she would save Rs 49,400. An individual earning Rs

15 lakh or above will save Rs 62,400 in tax.

Case

II— Salaried

individual claiming the most common deduction/exemptions, i.e. under sections

80C, 80D and standard deduction

Assuming the individual is

claiming these tax breaks: standard deduction of Rs 50,000, deduction of Rs 1.5

lakh under section 80C and Rs 25,000 under section 80D for medical premium. In

this case if the individual opts for the new personal tax regime then at gross

salary of Rs 7.5 lakh the person will have to pay Rs 20,800 extra tax, at a

gross salary of Rs 10 lakh the additional tax payable will be Rs 7,800 and at a

gross salary of Rs 12.5 lakh the additional tax payable will be Rs 5,200.

However, at a gross salary level of Rs 15 lakh or above the individual will

save tax of Rs 7800.

Therefore, a high earner

claiming only these deductions is likely to save tax under the new regime but

lower income earners up to gross salary of Rs 12.5 lakh will end up paying more

tax.

Case

III— Salaried

individual claiming more exemptions/deduction, i.e. under sections 80C, 80D,

standard deduction and HRA exemption

Assuming the individual is

claiming these tax breaks: standard deduction of Rs 50,000, deduction of Rs 1.5

lakh under section 80C and Rs 25,000 under section 80D for medical premium and

HRA exemption (varied as per salary income level). In this case if the

individual opts for the new personal tax regime then at gross salary of Rs 7.5

lakh (claiming HRA exemption of INR 150,000) the person will have to pay Rs

39,000 extra tax, at a gross salary of Rs 10 lakh (claiming HRA exemption of

INR 200,000) the additional tax payable will be Rs 49,400, at a gross salary of

Rs 12.5 lakh (claiming HRA exemption of INR 250,000) the additional tax payable

will be Rs 59,800, at a gross salary of Rs 15 lakh (claiming HRA exemption of

INR 300,000) the additional tax payable will be Rs 83,200 and at a gross salary

level of Rs 20 lakh (claiming HRA exemption of INR 400,000) the additional tax

payable will be Rs 117,000.