The GST council has slashed the GST rates of 178 items of daily use from tax bracket of 28% to 18% which will come in to effect by November 15th.Good and Services Tax council took a major step to simplify the process of GST returns filing during the meeting held last week. Now only 50 items left in the highest GST rates slab. The recommendations made by the GST council will reduce the compliance burden on businesses and ease the GST returns filing procedure for companies.

The item includes liquid soaps, chocolates, granite, detergents, perfumes, creams, wash basins, plywood, artificial flowers, panels, boards, tiles, ceramic pipes, glass mirrors, doors, fire extinguishers, compound optical microscopes, wrist-watches, razors and after-shave products which is a welcome step to benefit the consumers. There is no change in GST tax rates on consumer durables. These changes in GST rates of daily use items will increase the consumptions, affordability and consumer sentiment according to the industry experts.

In order to know more about the GST rates of other items included in 5%, 12% and 18% click here: https://www.trutax.in/gst-rate-slab

Changes in GST forms:

The GST council has decided to simplify the GST returns filing process for both small businesses and large enterprises. Before these changes the taxpayers had to file GSTR-1, GSTR-2 and GSTR-3 by 10th ,5th and 20th of the subsequent month respectively.

There are two cases for GST returns filing depends on turnover of businesses.

Businesses with turnover of up to Rs. 1.5 crore a year:

-The last date to file GSTR-1 form for July to September is December 31.

-The last date to file GSTR-1 form for October to December is February 15, 2018.

-The last date to file GSTR-1 form for January to March by April 30, 2018.

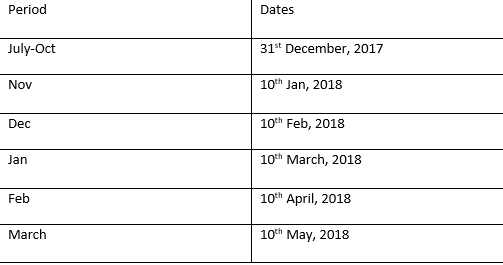

Companies with turnover of 1.5 crore or more a year:

-The last date to file GSTR-1 form for July to October is December 31.

-They have to file monthly returns but with a delay of 40 days from the end of the taxable period.

Know more about the details of other GSTR forms and its deadline dates: https://www.trutax.in/gst-returns-filing

Penalty for last filing of GST returns:

The GST council has also revised the penalty charges for late GST return filing to reduce the compliance burden on small and large businesses. The penalty for late filing of GST return has been cut to 20 per day from 200 per day for small business with a turnover of up to Rs. 1.5 crore and 50 per day for companies with the turnover of Rs. 1.5 crore or more.

It is very important to file the GST returns on time without any errors.

For any expert assistance related to GST returns filing process or query, click here: https://www.trutax.in/askexpert