- Eligibility for ITR-2 Filing?

-Individual or Hindu Undivided Family.

-Not eligible for ITR-1.

-Having Income under the head “Profits or gains of business.

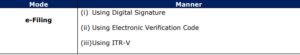

Manner of ITR-2 filing?

Reference: Income Tax e-filing website.

If you are eligible for ITR-2 filing then sign up on Trutax and file your income tax returns within few minutes: Income Tax e-filing

ITR-2 filing on Trutax:

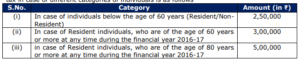

Every individual or HUF whose total income before allowing deductions under Chapter VI-A of the Income-tax Act, exceeds the maximum amount which is not chargeable to income tax is obligated to furnish his return of income. The maximum amount not chargeable to income tax in case of different categories of individuals is as follows

How to do ITR-2 filing?

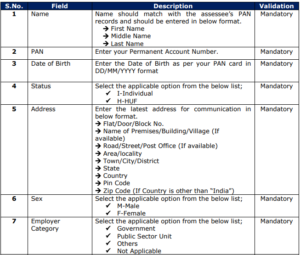

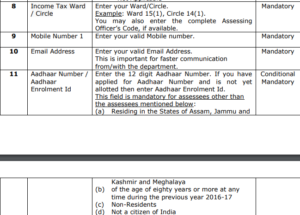

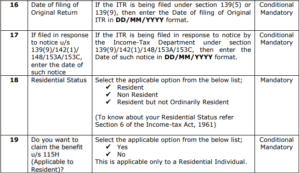

PART-A (GENERAL INFORMATION)

PART-A includes the details of assessee such as Name, PAN, Address information, Contact Information and relevant information to determine the assessee’s taxprofile.

`

PART B- TI Computation of Total Income.

PART B-TTI-Computation of Tax Liability on Total Income.

Under this section, the below details are available.

- Tax computation

- Rebate u/s 87A

- Relief u/s 89(1), 90, 90A and 91.

- Interest Chargeable u/s 234A, 234B, 234C

- Summary of Tax Payments like TDS, TCS, Advance Tax and Self-Assessment Tax.

- Net Tax Payable or Net Refund receivable.

- Bank Account Details.

- Resident individual or HUF has to select whether during the previous year they (i) hold, as beneficial owner, beneficiary or otherwise, any asset (including financial interest in any entity) located outside India or (ii) have signing authority in any account located outside India or (iii) have income from any source outside India?

- Verification

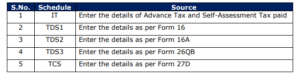

Schedule IT, TDS, TCS

Schedule-S:

- Fill the details of salary as given in TDS certificate(s) i.e., Form 16 issued by the employer(s).

- In case there was more than one employer during the year, please furnish the separate details with respect to each salary received from different employers.

Schedule-HP:

- This schedule is to be filled if you have a rental income.

- If there are more than two house properties, fill out the details for each property by selecting “Add Property” button.

- In case, a single house property is owned by the assessee, which is self-occupied and interest paid on the loan taken for the house property is to be claimed as a deduction then also this schedule shall be filled to claim deduction.

- In case the property is co-owned then the assessee needs to furnish the name of the co-owner, PAN and percentage of share of the other co-owner (s) in the property. In case of part ownership of property, the figure of annual value or rent receivable/received should be for whole of the property and only after computation of annual value the portion chargeable in own hands should be computed by multiplying such annual value with assessee’s percentage share in the property.

Schedule-IF:

This Schedule is to be filled if you are a partner in a firm. The below details of each firm in which you are partner are to be provided in this schedule:

- Name

- PAN

- Whether liable for audit

- Whether section 92E is applicable?

- Percentage share in the profit of the firm

- Amount of share in the profit.

- Capital Balance as on 31st March in the firm.

Schedule- BP:

Capital gains are bifurcated into:

- Short-term capital gain.

- Long-term capital gain.

Schedule-OS:

In this schedule provide the below details:

- The gross income by way of dividend and interest which is not exempt.

- Rental Income from hiring machinery, plant or furniture, building (where its letting is inseparable from the letting of the said machinery, plant or furniture), if it is not chargeable to income-tax under the head “Profits and gains of business o profession”.

- Any other income under the head other sources such as winning from lottery, crossword puzzles etc., income of the nature referred to in section 68, 69, 69A, 69B, 69C or 69D. The nature of such income is also required to be mentioned.

- Income from owning and maintaining race horses.

Schedule CYLA.

Schedule-BFLA

Schedule-CFL

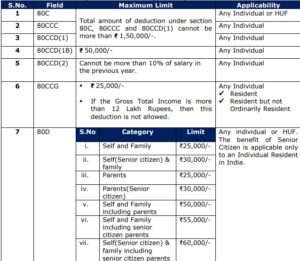

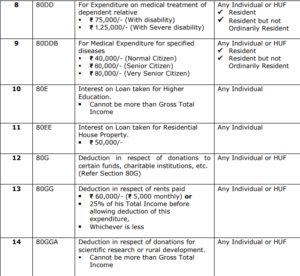

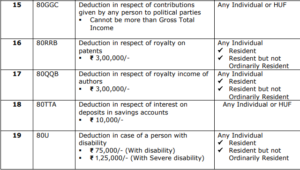

Schedule- VI-A

Schedule-80G:

Mention the details of donations entitled for deduction under section 80G. Donations entitled for deductions have been divided in four categories, namely:

- Donations entitled for 100% deduction without qualifying limit

- Donations entitled for 50% deduction without qualifying limit

- Donations entitled for 100 % deduction subject to qualifying limit

- Donations entitled for 50% deduction subject to qualifying limit

Schedule-SPI:

Furnish the details of income of spouse, minor child, etc., if to be included in your income in accordance with provisions of Chapter V of the Income-tax Act. The income entered into this Schedule has to be included in the respective head.

Schedule-SI:

In this schedule, incomes which is chargeable to tax at special rates shall be auto-calculated from the appropriate columns in schedule BFLA/CYLA or schedule OS.

Schedule-EI:

Furnish the details of income like Agriculture Income, Interest, Dividend etc. which is exempt from tax.

Schedule-PTI:

Fill the below details from business trust or investment fund as per section 115UA, 115UB.

- Name of business trust or investment fund.

- PAN of business trust or investment fund.

- Income from House property and TDS on such amount.

- Income from short-term capital gain and TDS on such amount

- Income from Long-term capital gain in column number 6 and TDS on such amount

- Income from other sources in column number 6 and TDS on such amount

- Income received from business trust or investment fund claimed to be exempt under section 10(23FBB), 10(23FD), etc.

Schedule FSI:

In this Schedule, fill the details of income, which is already included in total income, accruing or arising outside India.

Schedule TR:

In this schedule, fill the taxes paid outside India on the income declared in Schedule FSI which will be the total tax paid of schedule FSI in respect of each country and tax relief available which will be the total tax relief available in schedule FSI in respect of each country.

Schedule FA:

- This schedule is to be filled up by a resident assessee and not to be filled up by a ‘not ordinarily resident’ or a ‘non-resident’.

- Mention the details of foreign bank accounts, financial interest in any entity, details of immovable property or other assets located outside India.

- This should also include details of any account located outside India in which the assessee has signing authority, details of trusts created outside India in which you are settlor, beneficiary or trustee. Under all the heads mention income generated/derived from the asset.

- The amount of income taxable in your hands and offered in the return is to be filled out under respective columns.

- Item G includes any other income which has been derived from any source outside India and which has not been included in the items A to F and under the head business of profession in the return.

Schedule 5A:

- This Schedule is to be filled in case of assessee governed by Portuguese Civil Code.

- The share of income of the spouse should be filled in this schedule and the same should form part of the return of income of the spouse.

Schedule AL:

- This Schedule is to be filled by individuals and HUFs giving details of properties held by the assessee and the corresponding liabilities.

- It is mandatory if your total income exceeds ₹50 lakh.

- The assets to be reported will include land, building (Immovable Assets); financial assets bank deposits, shares and securities, insurance policies, loans and advances given, cash in hand and Jewellery, bullion, vehicles, yachts, boats, aircraft etc. (Movable Assets) and interest held in the asset of a firm or association of persons (AOP) as a partner or member thereof.

- In the case of non-resident and resident but not ordinarily resident, the details of assets located in India are to be mentioned.

File your Income Tax Return and Get a call back from our expert for any query related to ITR-2 Filing or income tax filing assistance: Income Tax Return e-filing