Who can file ITR-1?

ITR-1 is applicable to individuals whose total income includes:

- Income from Salary or Pension.

- Income from one House Property.

- Income from other sources excluding winning lottery income and horse racing income.

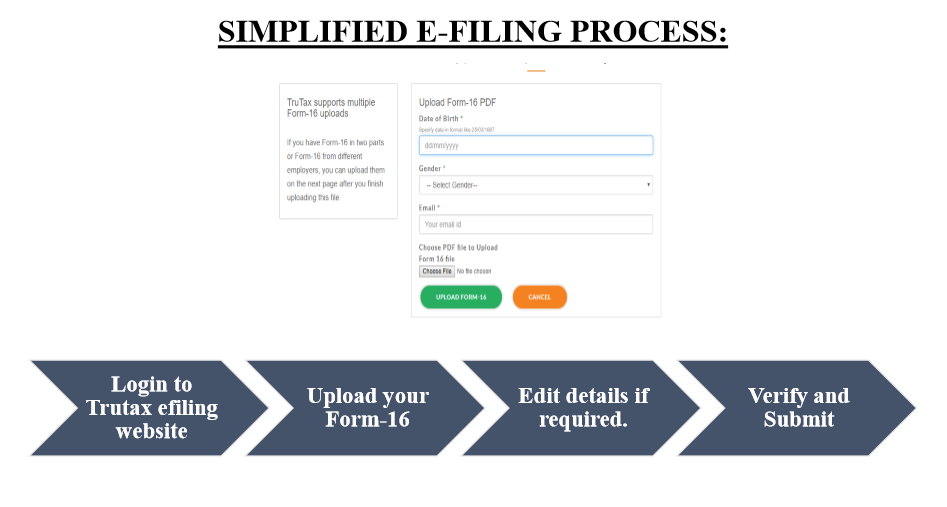

If you are eligible for filing ITR-1 then sign up on Trutax and file your income tax returns within few minutes: e-filing ITR-1

Who can’t file ITR-1 :

ITR-1 is not applicable to individuals whose income includes:

- Income from lottery winning and horse racing.

- Income from more than one House Property.

- Income taxable under Section 115BBDA.

- Income under the head “Capital Gains” which is a short-term capital gain or long-term capital gains.

- Loss under the head “Income from other Sources”.

- Agriculture Income in excess of Rs. 5000.

- Income from Business or Profession.

- Any Resident having asset located outside India.

- Any Resident having an income source from outside India.

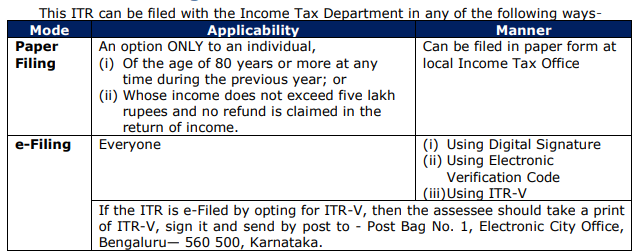

Manner of filing ITR-1

Anyone can e-file their income tax returns using Digital Signature, using Electronic Verification Code and using ITR-V.

Reference: Income Tax e-filing website.

Trutax is simplest way to file your income tax returns anytime and anywhere.

How to fill the ITR-1 form?

ITR-1 form contains various fields which should be filled with correct information and any wrong information in ITR-1 will lead to cancellation of return filing.

The various fields in ITR-1 Form include:

- PAN

- Name

- Aadhaar Number

- Date of Birth

- Mobile Number

- Email Address

- Address

- Employer Category

- Residential Status

- Return Filed

- Whether Original or Revised Return.

- Original Acknowledgment Number

- Date of filing of original Return

- Notice Number

- If filed in response to notice u/s 139(9)/142(1)/148/153A/153C, enter the date of such notice.

- Are you governed by Portuguese Civil Code as per section 5A.

- If Yes, Fill PAN of the Spouse.

PART-B (ITR-1)

- Income from Salary/Pension.

- Type of House Property.

- Income from one House Property.

- Gross Total Income.

PART-C (INCOME TAX DEDUCTIONS)

80C, 80CCC, 80CCD(1), 80CCD(1B), 80CCD(2), 80CCG, 80D, 80DD, 80DDB, 80E, 80EE, 80G, 80GG, 80GGA, 80GGC, 80RRB, 80QQB, 80TTA, 80U.

PART-D (Computation of tax payable)

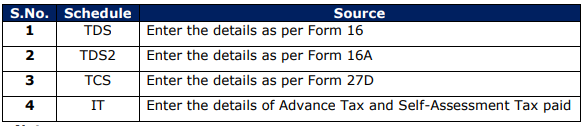

Tax Payment Details:

Reference: Income Tax e-filing website

Exempt Income Details.

Bank Account Details.

Verification.

Fill up the simple form and get a call back for any information related to ITR-1 filing: Trutax Query Form