fianancial

New GST Changes

The government has implemented a new way for the taxpayers under the Goods & Services Tax which allows them to switch to a new and simpler return form. To help …

Read MoreWhy You Should Hire Experts Or A Tax Agency Services To Help With New GST Rules?

Just ask yourself a simple question, Do you want your work to be just good or you want it to be the best possible. The answer is simple if you …

Read MoreSpecial Allowances And Deduction U/s 10

Under Section 10, individuals are given certain special allowances for the amount they spent for specific purposes. Apart from the net salary, an employee receive various allowances for specific purposes …

Read MoreHow to file IT return for previous years?

Before getting to the point, it is required to understand the meaning of following terms: Belated Return: If you file your income tax return after due date(31st March Of …

Read More

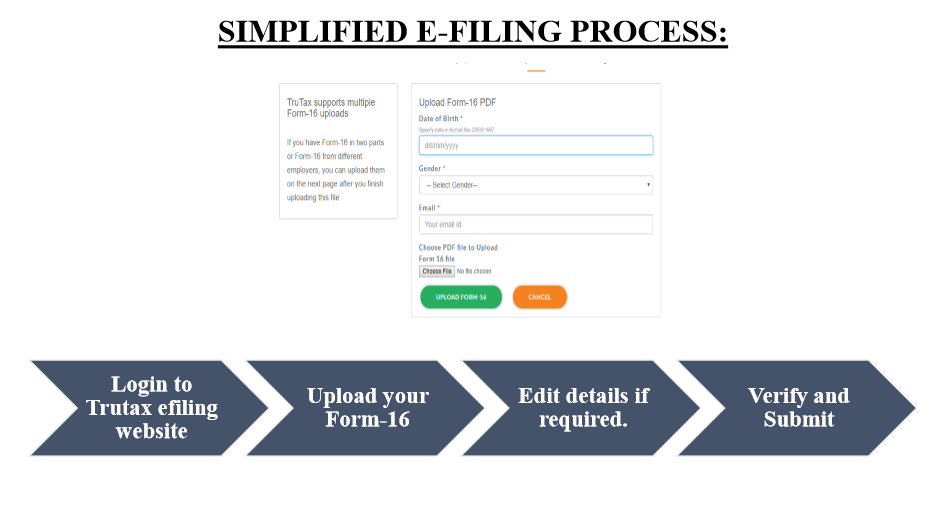

All You Need To Know About Form 16

ITR Form 16 is one of the most common financial documents anyone could come across when filing for Income Tax Return. This year, the Income Tax department has studied the …

Read MoreHow to File Income Tax Online?

How to File Income Tax Online? Paying Online Income Tax from time to time is a duty for any individual taxpayer through Onlne, there are many taxpayers who have already …

Read MoreHow to reduce Taxation and Financial Planning

Taxation and Financial Planning: We know that knowing the tax ramifications of any investment is essential to developing a complete plan for our life. Without the intimate knowledge of taxation in …

Read MoreChecklist of documents required for E-filing income tax return

The due date for filing income tax return is nearing which is 31st July so you need to know about the various important documents required in details for filing your income tax returns.

Have you collected all the documents required for filing income tax returns? If not, then you should do it as early as possible to meet the deadline of due date before it gets too late for the process.

Read More