This year government has taken a key step and mindful step in order to change the current scenario of distinction between disclosure of income and expenditure.

The government has made important changes in income tax return forms to bring about ease in disclosing income and filing of returns by individuals or taxpayers.

Due to these new changes now filing the income tax return is easy, less complicated and simply understood by any individuals filing their income tax returns.

The largest change in income tax return form is a simplified one page form (ITR-1) for individuals having income from salary, one house property , pension and other sources like interest etc.

Those who have income more than 50 lakh or own more than one house property will need to file ITR-2 form.

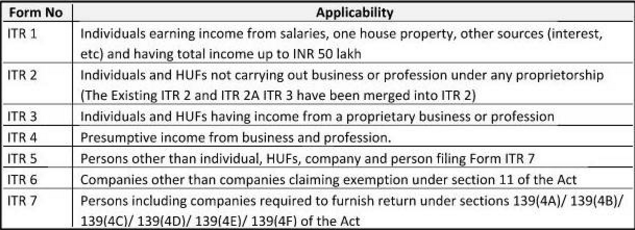

The list of income tax return forms for FY 2017-18 and their applicability.

Disclosure of Aadhaar number:

Mentioning of Aadhaar number is mandatory in order to file income tax returns.Till last year it was optional to mention the Aadhaar number while filing the return.This year you have to mention the 12-digit Aadhaar number or the 28-digit enrollment number while filing the income tax return.

Disclosure of Cash deposited during demonetisation:

The tax department has introduced a new column in all ITR forms where the person filing tax will have to give details of the money deposited and bank account during the demonetisation period.

If a person has deposited Rs 2 lakh or more he or she will mention the IFSC code,name of bank,account number along with the amount deposited in the income tax return.

Unexplained Income:

New column have been inserted under “Schedule OS” to report unexplained income which will be taxed at the rate of 60 percent.

The asset and liability column has been removed from ITR-1 form.Earlier a person having income of more than Rs 50 lakh in a year had to declare assets and liabilities while filing the tax return.It has been done away with in ITR-1 form as now a person with income over Rs 50 lakh can’t file ITR-1.All the other forms still have the asset and liability column.

Deductions under Section 80EE:

A new field has been inserted in the new ITR forms under Schedule VI-A deduction to claim home loan interest under Section 80EE of the Act.

Section 80EE allows deduction on home loan interest for first time home buyers to the extent of Rs. 50,000.This deduction is over and above the Rs 200,000 limit currently permitted for house property covered under section 24(b).

The number of income tax forms has been reduced from earlier nice to seven.ITR-2,ITR-2A and ITR-3 have been done away with and merged to new ITR-2.

ITR-2A was filed by those having more than one house property.While ITR-3 was filed by those having income from business and profession.

If you have more than one house property or income from business then you will have to file new ITR-2 forms.

As the ITR 2A and ITR 3 no longer exist,ITR-4 and ITR-4S have been renumbered as ITR-3 AND ITR-4.