Under the income tax act,different types of interests are levied for various kinds of delays/defaults.In this article we will discuss interest payable under section 234A,234B,234C of the income tax act for default in furnishing return of income,default in payment of advance tax and deferment of advance tax.

To understand different interest types of interest, we should have knowledge about the provisions of section 234A,234B and 234C dealing with the interest for:

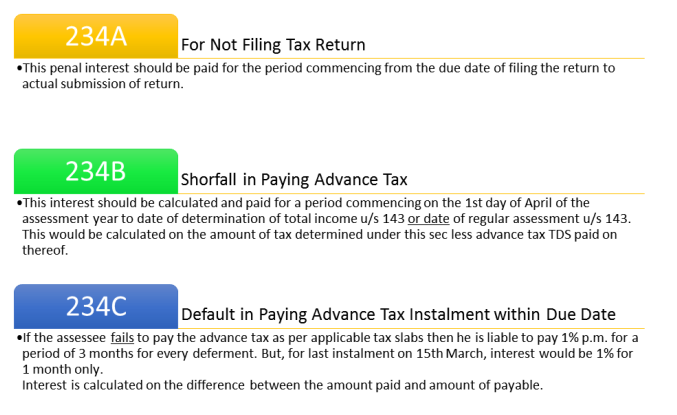

- Section 234A-Default in filing of tax returns.

- Section 234B-Default in payment of advance tax.

- Section 234C-Deferment of Advance tax.

Section 234A-Delay in filing the return of income

When the return of income for any assessment year is furnished after the due date or is not furnished, the assessee shall be liable to pay simple interest at the rate of one per cent for every month or part of a month for the period commencing on the date immediately following the due date up to the date of furnishing in return or upto the end of the Assessment year on the amount of shortfall in total income tax payable by the assessee.

Section 234B-Default in payment of advance tax

All assesses including salaried employees,freelancers,businessmen etc are required to pay advance tax where the tax payable is Rs.10,000 or more.

If you don’t pay advance tax, you may be liable to pay interest under section 234B.

An assessee who is liable to pay advance tax has failed to pay such tax or where the advance tax paid by such assessee is less than ninety per cent of the assessed tax, the assessee shall be liable to pay simple interest at the rate of one per cent of every month or part of a month for period from the date on which the payment of advance tax became due on the amount of shortfall in the amount of advance tax paid.

Example:

Ajay is freelancer has a total tax liability of Rs.55,000.Ajay paid his tax liability at the time of filing his return on 13th Junee.

Since Ajay’s total tax liability is more than Rs.10,000 and he is liable to pay advance tax.

Here is the interest calculation:

Rs.55,000 x 1% x 3 (April,May,June)=Rs. 1,650

Ajay is liable to pay Rs. 1,650 interest as per Section 234B.

Section 234C-Deferment of Advance tax

Interest is payable @1% for 3 months on the amount of shortfall in payment of advance tax became due on 15th June (applicable only to corporate assessees), 15th September(all assessees ) and 15th December (all assessees) and interest @1% on the amount of shortfall in payment of advance tax became due on 15th March (all assessees).

Important Note:The last date for e-filing of IT returns is 31st July 2017.